Key Points

- Amendment Signed: BrainChip Holdings Ltd (ASX: BRN) has announced the fourth amendment to its Put Option Agreement (POA) with LDA Group, extending access to capital until June 2026.

- Increased Funding: The Total Commitment Amount under the agreement has increased by AUD $37M to AUD $140M, with an additional Minimum Drawdown Amount of AUD $20M required by June 2026.

- Support for Growth: Funds raised will advance the development of Akida 2.0 products, expand the TENN model portfolio, and support commercialisation initiatives.

Agreement Details

- Collateral Shares: BrainChip will issue 40 million Collateral Shares by 30 June 2025 or the next Capital Call, whichever comes first.

- Pricing Terms: LDA’s purchase price remains 91.5% of the daily VWAP during the pricing period.

- Placement Capacity: Any issuance of shares will adhere to BrainChip’s Listing Rule 7.1 placement capacity.

Strategic Context

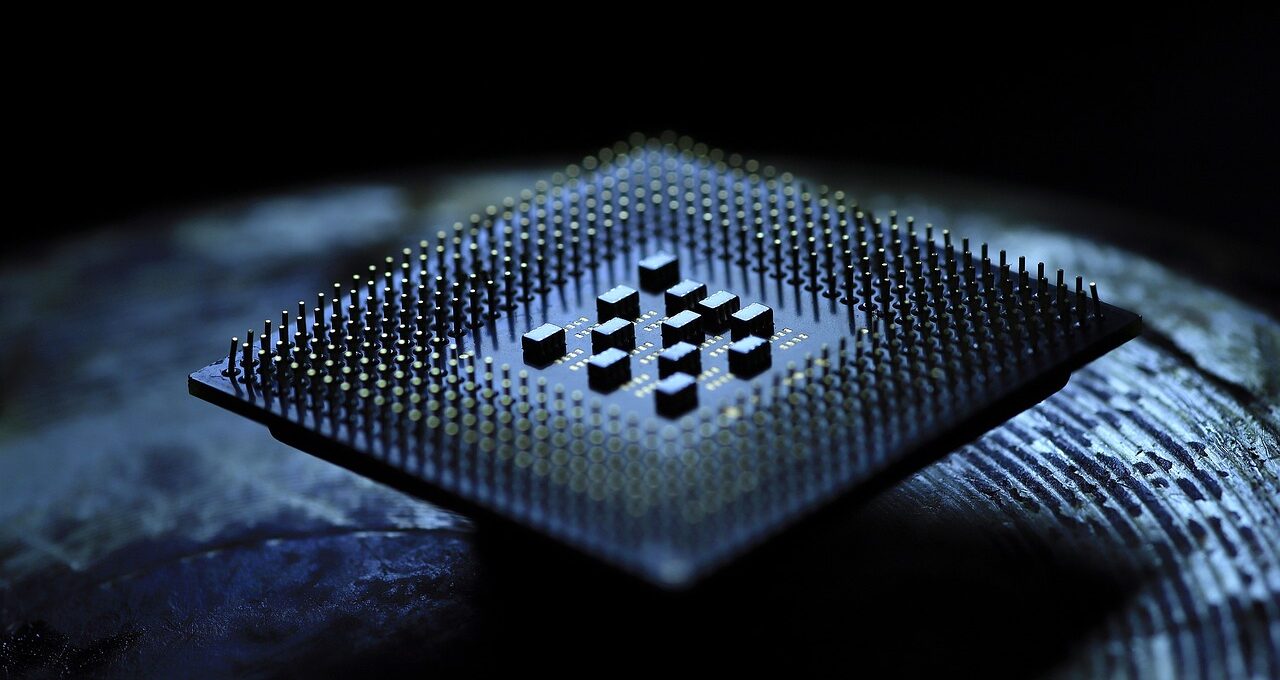

BrainChip’s Akida™ neuromorphic processor continues to gain traction in edge AI markets, excelling in streaming data processing at the edge. CEO Sean Hehir noted:

“With the growing momentum of our 2nd generation Akida™ products and our exceptional TENNs solutions, we recognize the need to accelerate investments to drive growth and solidify our market leadership. Having access to funding from our respected partners at LDA Group enhances our ability to remain competitive while maintaining prudent cash management.”

About BrainChip Holdings Ltd (ASX: BRN)

BrainChip is a pioneer in edge AI processing, with its Akida™ neuromorphic processor offering groundbreaking energy efficiency, low latency, and enhanced privacy. Its innovative technology is transforming real-world applications, including connected vehicles, IoT devices, and consumer electronics, by enabling AI processing directly at the sensor level.

With the extended funding support, BrainChip is well-positioned to scale its Akida platform and secure its role as a global leader in on-chip AI solutions for the edge.